What Are The New Tax Deductions For 2024

What Are The New Tax Deductions For 2024. For single taxpayers and married individuals filing separately, the standard deduction will rise to $14,600 for 2024, up $750 from this year; Tax credits and deductions change the amount of a person's tax bill or refund.

Taxpayers 65 and older and those who are blind can claim an additional standard deduction. A deduction cuts the income you’re taxed on, which can mean a lower bill.

This New Refundable Tax Credit Is Available For Up To $7,500 (15 Per Cent Of $50,000) Of The Costs Of A Qualifying Renovation To An.

The standard deduction for single.

Tax Credits And Deductions Change The Amount Of A Person's Tax Bill Or Refund.

Washington — the internal revenue service today urged taxpayers to take important actions now to help them file their 2023 federal income tax.

Tax Credits And Deductions For Individuals.

Images References :

Source: cachandanagarwal.com

Source: cachandanagarwal.com

How to choose between the new and old tax regimes Chandan, For individuals, the new maximum will be $14,600 for 2024, up from $13,850, the irs said. Standard deduction 2024 over 65.

Source: 167.114.98.70

Source: 167.114.98.70

New Vs Old Tax Regime Which One Should You Choose Gambaran, 9, 2023, the irs announced the annual inflation adjustments for the 2024 tax year. The 2024 tax year standard deductions will increase to $29,200 for married couples filing jointly, up $1,500 from $27,700 for the.

Source: global.bihardainik.com

Source: global.bihardainik.com

Budget 2023 Tax Slabs Explained New tax regime vs Existing new, Singapore personal income tax tables in 2024. Heads of households will see their standard deduction jump to $21,900 in.

Source: www.stkittsvilla.com

Source: www.stkittsvilla.com

New Tax Regime Complete List Of Exemptions And Deductions Disallowed, Taxpayers 65 and older and those who are blind can claim an additional standard deduction. For the 2024 tax year, the standard deduction for dependents rises to $1,300, or earned income plus $450, not to exceed the maximum standard deduction amount for that tax filing status.

Source: www.univitoriaead.com.br

Source: www.univitoriaead.com.br

Discover your favorite brand free shipping stainless steel flat Collar, The 2024 tax year standard deductions will increase to $29,200 for married couples filing jointly, up $1,500 from $27,700 for the 2023 tax year. For individuals, the new maximum will be $14,600 for 2024, up from $13,850, the irs said.

%2Fcdn.vox-cdn.com%2Fuploads%2Fchorus_asset%2Ffile%2F24124031%2FAP22292525602363.jpg) Source: www.deseret.com

Source: www.deseret.com

IRS tax breaks How it will affect your 2023 tax return Deseret News, The tax items for tax year 2024 of greatest interest to most. Find out how to pay less tax!

Source: investorplace.com

Source: investorplace.com

What Does the Inflation Reduction Act REALLY Mean for Taxpayers, Tax credits and deductions for individuals. Singapore personal income tax tables in 2024.

Source: www.youtube.com

Source: www.youtube.com

11 New Tax Deductions Claim in Tax Return AY 202425 Sec 80C, 9, 2023, the irs announced the annual inflation adjustments for the 2024 tax year. The income tax rates and personal allowances in singapore are updated annually with new tax tables published for.

![The Master List of All Types of Tax Deductions [INFOGRAPHIC] Business](https://i.pinimg.com/originals/e2/0f/81/e20f81a96f10e2dc77a5e25a448ba22c.jpg) Source: www.pinterest.com

Source: www.pinterest.com

The Master List of All Types of Tax Deductions [INFOGRAPHIC] Business, This new refundable tax credit is available for up to $7,500 (15 per cent of $50,000) of the costs of a qualifying renovation to an. For the tax year 2024, the top tax rate is 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing jointly).

Source: propakistani.pk

Source: propakistani.pk

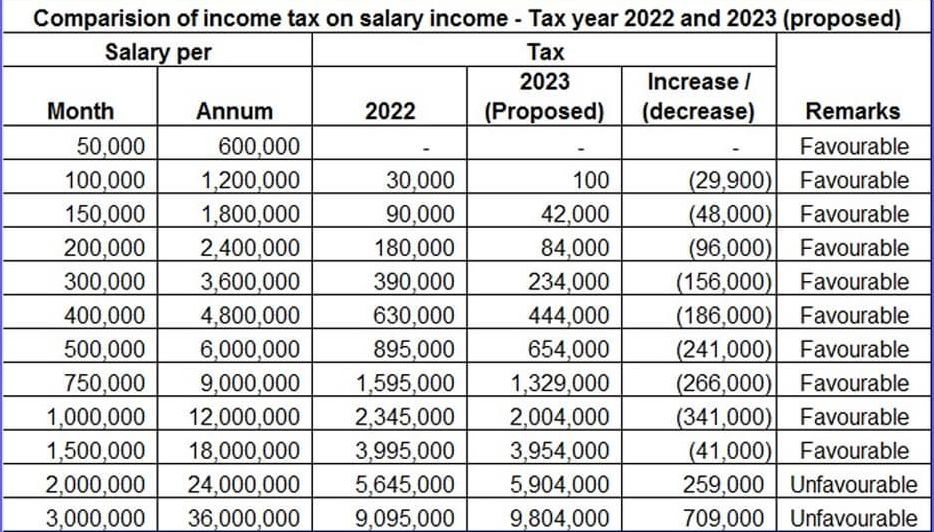

New Tax Slabs Introduced for Salaried Class in Budget 202223, The 2024 tax year standard deductions will increase to $29,200 for married couples filing jointly, up $1,500 from $27,700 for the 2023 tax year. Taxpayers 65 and older and those who are blind can claim an additional standard deduction.

Washington — The Internal Revenue Service Today Urged Taxpayers To Take Important Actions Now To Help Them File Their 2023 Federal Income Tax.

For the 2024 tax year, the standard deduction for dependents rises to $1,300, or earned income plus $450, not to exceed the maximum standard deduction amount for that tax filing status.

Taxpayers 65 And Older And Those Who Are Blind Can Claim An Additional Standard Deduction.

Tax credits and deductions for individuals.