California State Income Tax Brackets 2024 Married Filing

California State Income Tax Brackets 2024 Married Filing. You pay tax as a percentage of your income in layers called tax brackets. Quarterly estimated tax payments for 2024:

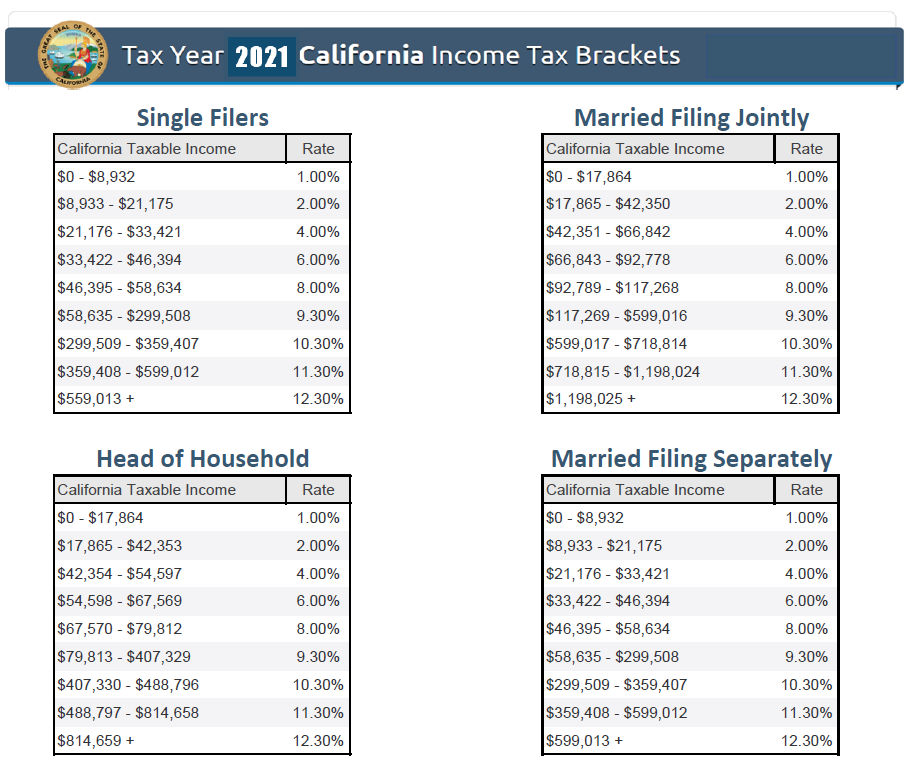

1% on the first $8,544 of taxable income. California residents state income tax tables for married (joint) filers in 2024 personal income tax rates and thresholds (annual) tax rate taxable income threshold;

1% On The First $8,544 Of Taxable Income.

Income tax tables and other tax information is sourced from the california franchise tax board.

The Annual Salary Calculator Is Updated With The Latest Income Tax Rates In California For 2024 And Is A Great Calculator For Working Out Your Income Tax And Salary After Tax Based.

For example, a single filer with an.

Yes, As Georgia Does Not Tax Social Security And Provides A Deduction Of $65,000 Per Person On All Types Of Retirement Income For Anyone Age 65 And Older.

Images References :

Source: celestynwuna.pages.dev

Source: celestynwuna.pages.dev

California Tax Brackets 2024 Chloe Carissa, California tax brackets 2020 in 2020 tax brackets. Tax brackets 2024 married jointly california form.

Source: charmainwluci.pages.dev

Source: charmainwluci.pages.dev

2024 California Tax Brackets Married Filing Jointly Amalea Blondell, The deadline to file a california state tax return is april 15, 2024, which is also the deadline for federal. Note, the list of things not.

Source: neswblogs.com

Source: neswblogs.com

2022 California State Tax Brackets Latest News Update, California's 2024 income tax ranges from 1% to 13.3%. If you're age 62 to.

Source: bibbieqjordan.pages.dev

Source: bibbieqjordan.pages.dev

2024 California Tax Brackets Table Maren Sadella, 2% on taxable income between $8,545 and $20,255. Income tax tables and other tax information is sourced from the california franchise tax board.

Source: barbeajillene.pages.dev

Source: barbeajillene.pages.dev

California Tax Brackets 2024 Viva Catherine, If you're age 62 to. It would have set the top rate for married couples filing jointly at 5.57% and the bottom rate at 5.2%, with $46,000 serving as the dividing line between the two rates.

Source: annalisewagace.pages.dev

Source: annalisewagace.pages.dev

Tax Brackets 2024 Married Jointly California Dody Carleen, 2024 california and federal income tax brackets below is a quick reference table for california and federal income taxes for 2024. Tax brackets and rates 2024.

Source: federal-withholding-tables.net

Source: federal-withholding-tables.net

California State Tax Table 2021 Federal Withholding Tables 2021, Some states have a flat. Tax brackets 2024 usa married jointly hedy ralina, for 2024, the maximum earned income tax credit (eitc) amount available is $7,830 for married taxpayers filing jointly.

Source: dorisachloris.pages.dev

Source: dorisachloris.pages.dev

Federal Tax Due Date 2024 For California Residents Judye Marcile, 2024 california and federal income tax brackets below is a quick reference table for california and federal income taxes for 2024. While federal tax rates apply to every taxpayer filing a tax return in the united states, state income taxes vary by state.

Source: camilleoauria.pages.dev

Source: camilleoauria.pages.dev

Ca State Tax Brackets 2024 Bobbi Chrissy, 1%, 2%, 4%, 6%, 8%, 9.3%, 10.3%, 11.3%, and 12.3%. 1% on the first $8,544 of taxable income.

Source: roguevalleyguide.com

Source: roguevalleyguide.com

2022 Tax Brackets Married Filing Jointly California Kitchen, Tax rate taxable income (married filing separately) taxable income (head of. $20,800 for heads of household.

What Is The Deadline For Filing California State Taxes In 2024?

This makes it important to.

It Would Have Set The Top Rate For Married Couples Filing Jointly At 5.57% And The Bottom Rate At 5.2%, With $46,000 Serving As The Dividing Line Between The Two Rates.

If you’re age 62 to.